Chase Freedom Flex Q1 2026 Bonus Categories

Chase has announced the new Q4 2025 bonus categories the Chase Freedom Flex where you can earn 5x points on select categories. If you haven’t picked it up yet, it is one of the best no annual fee cards out there. It is also time to activate the offer now so you can hit the ground running on January 1st.

Why This is Such a Great Card

The Chase Freedom Flex is an incredible no annual fee card which offers 5% cash back on rotating categories each quarter. Now, if you have a Chase Sapphire Preferred, the Sapphire Reserve, or the Ink Business Preferred, you can earn 5x Ultimate Rewards points instead of cash back. I value Ultimate Rewards points at 1.7 cents per point which increases your return from 5% to 8.5%.

You can earn 5 points per dollar on the first $1,500 spent across all categories each quarter for a total of 7,500 points. Maximizing each quarterly bonus means you can earn up to 30,000 points each year. That’s a crazy good deal especially considering this card has no annual fee.

Earn 5x points on Norwegian Cruise Line, Dining, and the American Heart Association in Q1

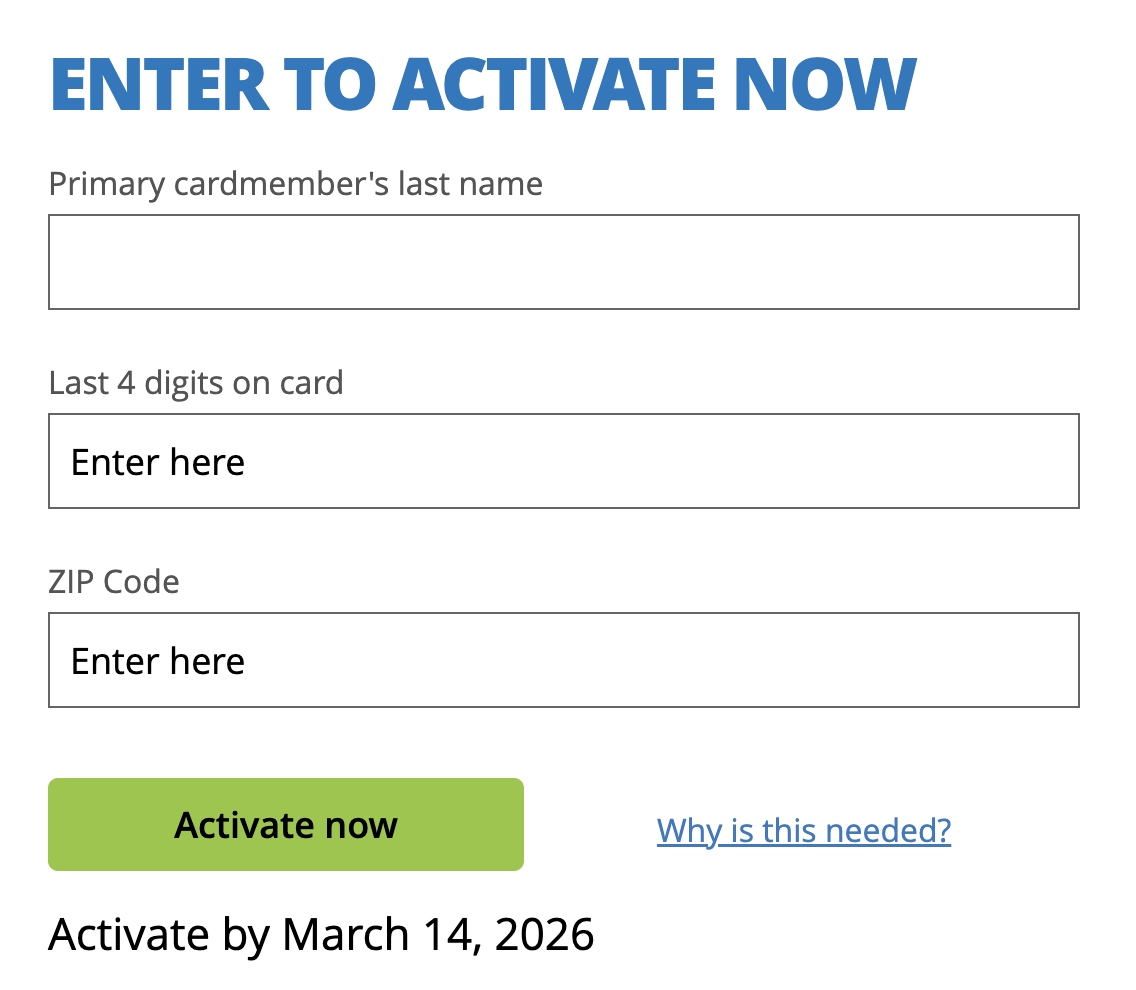

Registration is open and the bonus goes into effect on January 1st. If for whatever reason you forget, you have until March 14th to activate this. All you have to do is go to https://www.chasebonus.com/ enter in your last name, ZIP code, and the last 4 digits of your card. Its as simple as that.

Activate Your Offer Today

What’s in Store for Q1 2026

This quarter should be pretty easy to maximize with the dining category. Earning 5x points on dining makes the Chase Freedom one of the best cards for dining during Q1.

Norwegian Cruise Lines

Dining

American Heart Association

Wrapping Up

The Chase Freedom Flex is one of the best no annual fee cards out there. Earning 5x points on the first $1,500 spent on Norwegian Cruise Lines, Dining and the American Heart Association from January 1st through March 31st, 2026. This is another great card to keep in your wallet to always earn more than 1 point per dollar on all purchases.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

The content on this page is accurate as of the publish date; however, some of the offers mentioned may have expired.