The Three New Bilt Cards

After launching the world’s most complicated points program, we’re also going to see three new credit cards from Bilt. Two of the three are disappointing while only one is exciting in my opinion. And what happens to existing cardholders?

What Happens to Existing Cardholders?

For those that currently have a Bilt Mastercard, you have until January 30th, 2026 to decide what to do. This is what you’ll need to choose:

Don’t move forward with Bilt.

Convert your existing Bilt card to a Wells Fargo Autograph

Close your account

Choose one of three new cards

Will arrive by February 7th

Balance will be transferred to new card

Automatically updated in your mobile wallet

Card number stays the same

The good news is that there will not be a new hard pull on your credit report, however we are seeing existing cardholders receiving significantly lower credit limits. On the flipside to that, your housing payments won’t actually come off your credit line but will be taken out of your bank account via ACH. This probably won’t be ideal for some people as they could float their rent payment throughout the month.

Bilt Blue Card

Bilt Blue Card

The no annual fee Bilt Blue card is the most basic and boring card of the lot. My guess is that most existing cardholders will choose this card who aren’t into credit card points.

$100 Bilt Cash sign-up bonus

1x points plus 4% Bilt Cash on every purchase

Ability to earn points on rent or mortgage payments

No annual fee

Bilt Obsidian Card

Bilt Obsidian Card

Sitting right in the middle of the three new cards is the Bilt Obsidian card. This will offer a few bonus categories to earn extra points on certain transactions with just a $95 annual fee.

$200 Bilt Cash sign-up bonus

3x points on your choice either grocery store (up to $25k spent) or dining purchases

2x on travel

1x point on everything else

4% Bilt Cash on all purchases

Ability to earn points on rent or mortgage payments

$95 annual fee

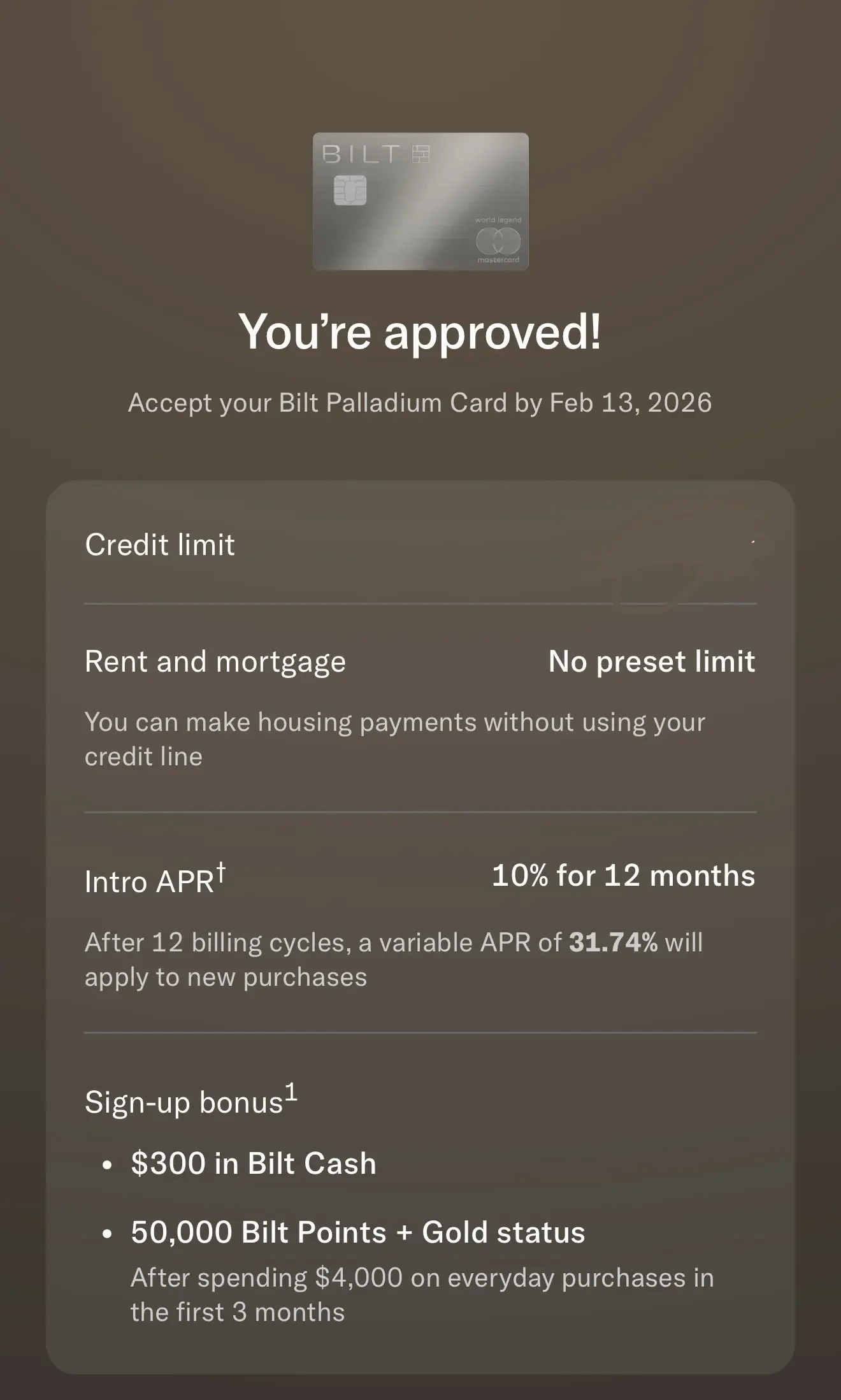

Bilt Palladium Card

Bilt Palladium Card

The card with the highest annual fee is also the card I’m most excited about. With a $495 annual fee this card earns 2x points on all everyday purchases with a few additional benefits.

A 50,000 point and Bitl Gold status as a sign-up bonus after spending $4,000 (not including rent or mortgage) in the first 3 months.

$300 Bilt Cash on approval

2x points on all purchases

Ability to earn points on rent or mortgage payments

$400 Bilt Travel Hotel credit

$200 twice a year for hotels booked through Bilt Travel with a minimum 2 night stay

$200 Bilt Cash every year

Priority Pass membership

My Thoughts

This is a massive change to the Bilt program. They’re going from having just one card where you earned points on your rent after just 5 transactions to having three cards where you need to spend at least 75% of your housing payment to earn the same 1x point per dollar.

The Bilt Blue card will likely be what most people transition to. There are better cards like the American Express Gold for dining and grocery store purchases, so the Bilt Obsidian card doesn’t make much sense.

My Approval for the Bilt Palladium Card

I got approved for the Bilt Palladium card. With the 50,000 point sign-up bonus, along with $300 Bilt Cash annually, Gold status, and 2x points on all purchases it was an easy decision for me. I’ll be interested to see what it is like after the first year and if I keep it. I’m not sure which option I’ll go with but I’ll essentially be getting 3x-3.25x points per dollar on purchases up to the amount of my mortgage.

The content on this page is accurate as of the publish date; however, some of the offers mentioned may have expired.